September 13, 2024

The wars in Ukraine and Gaza, along with other global tensions, have brought the military and defense sector back into focus for investors. This sector is complex and faces challenges in meeting ESG (Environmental, Social, and Governance) compliance standards. It primarily serves a limited number of clients, and its performance fluctuates with government spending. As geopolitical tensions rise, global military expenditure continues to increase. Defense spending in Europe has grown significantly, while North America has seen only modest growth, not keeping pace with Europe.

In 2023, combined defense spending rose by more than 10% compared to 2022. This upward trend is expected to continue until 2030, as Western nations invest in modernizing and enhancing their capabilities, with a renewed focus on conventional warfare rather than counterinsurgency operations. Additionally, maritime surveillance and intervention have become increasingly important. Technologies such as detectors, combat management systems, surveillance and tracking solutions, and geographic information systems are gaining prominence, partly due to the Red Sea crisis and the Iran-backed Houthi attacks on shipping lanes.

Historically, defense companies have been at the forefront of technological innovation, with digitalization serving as a key driver. Advances in artificial intelligence (AI), autonomous and unmanned systems, cybersecurity, hypersonic weapons, and space technologies are creating new market opportunities in the sector.

Given these developments, we sought to better understand how technology contributes to the value of defense businesses.

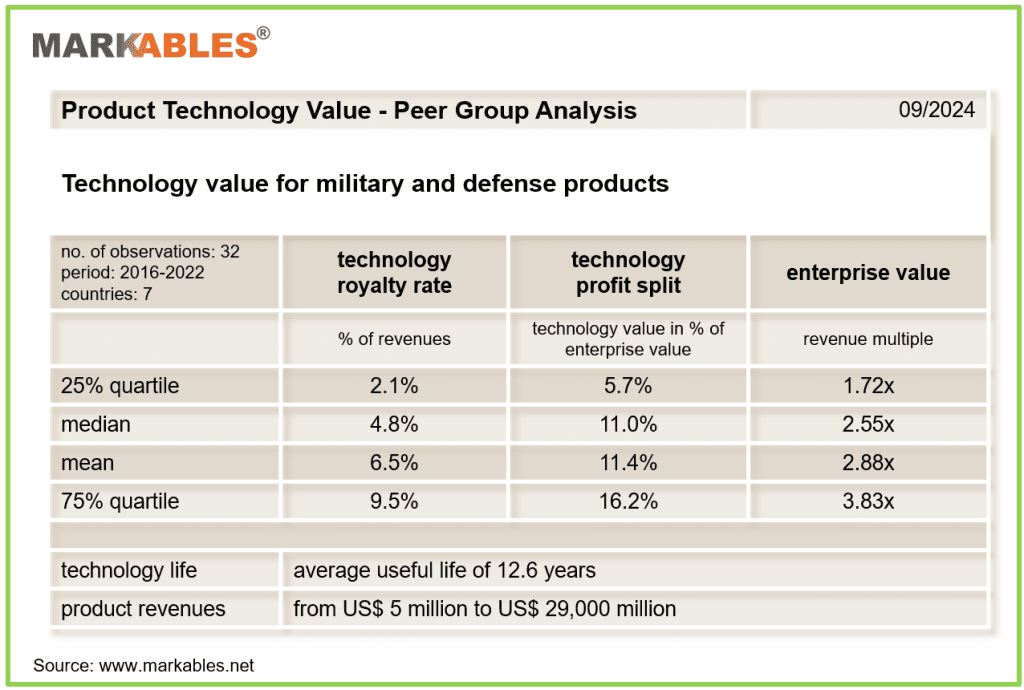

For military product technology—referring to any technology related to physical products—we examined a peer group of 32 military businesses acquired between 2016 and 2022. Our findings revealed the following key ratios and percentages concerning their technology assets:

These metrics place military technology between high-tech engineered products, such as medical technology, and lower-tech engineered products like general and special machinery. The useful life of military technology is around 12 years, similar to other sectors. Why aren’t the value parameters of military technology higher? Likely because a significant portion of military products involve base technology or expensive materials. However, the technology component often remains a “hotbed” for innovation.

Regarding software applications in the defense sector, we analyzed a peer group of 39 software providers acquired between 2015 and 2023. Unsurprisingly, the value parameters for software are significantly higher than those for hardware technologies:

The useful life of military software is notably shorter, averaging around seven years. These figures align military software applications closely with other B2B software sectors.

In summary, the military sector is certainly technology-driven, but it is not as high-tech as some other industries. This can be attributed to the limited growth prospects and scalability of technology, which are constrained by government budget restrictions. This is a fundamental difference from open, unregulated markets.

MARKABLES is a provider of comparable data for the valuation of intangible assets. Our database comprises value data on 3,500+ different technology portfolios, and on 3,750+ different software applications. In addition, we have large data repositories for trademarks, customer portfolios and goodwill.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland