November 19, 2024

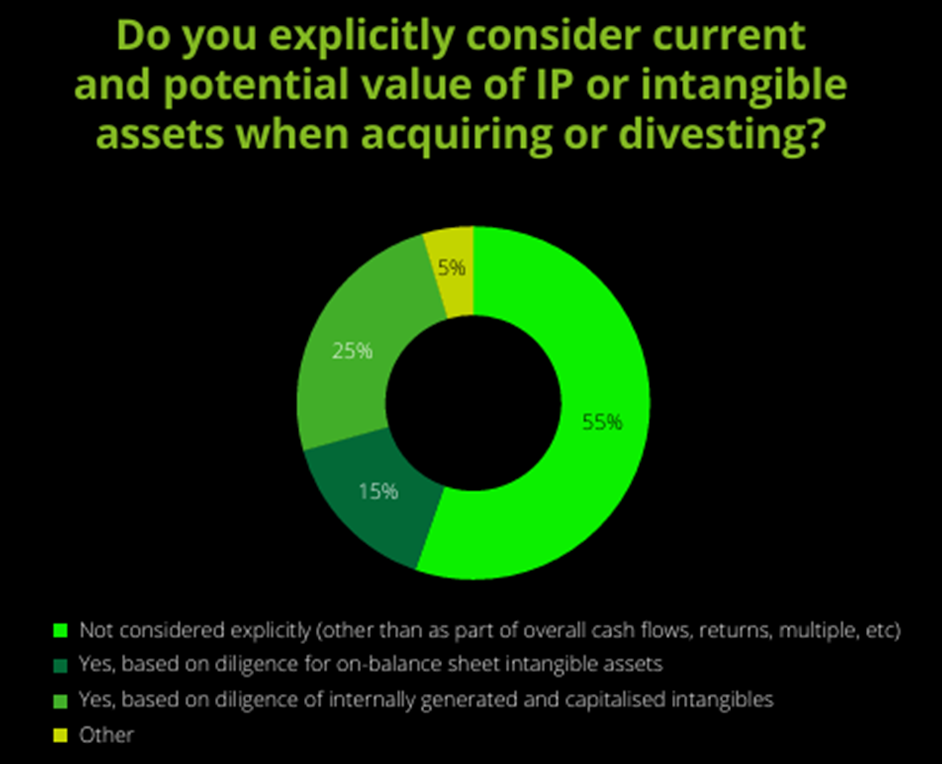

We all know: Intangible assets make up very large parts of company value. But do we know that 70% of M&A leaders don’t explicitly consider the potential value of internally generated IP assets in the M&A process. This is a finding of Deloitte’s 2024 M&A survey with M&A leaders of 130 firms in Australia.

In other words, for large parts of the deal value, M&A leaders don’t know what they get from a deal. That’s a shame. Post-deal valuation of acquired intangible assets, as required by international accounting standards, can be performed pre-deal as well. Provided that they are properly planned and organized. A major step towards deal quality.

Changing perspective, showcasing existing IP value to buyers is also one of the strongest arguments a seller can have.

MARKABLES has the largest and most comprehensive set of market comps to support the valuation of intangible assets.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland