November 7, 2024

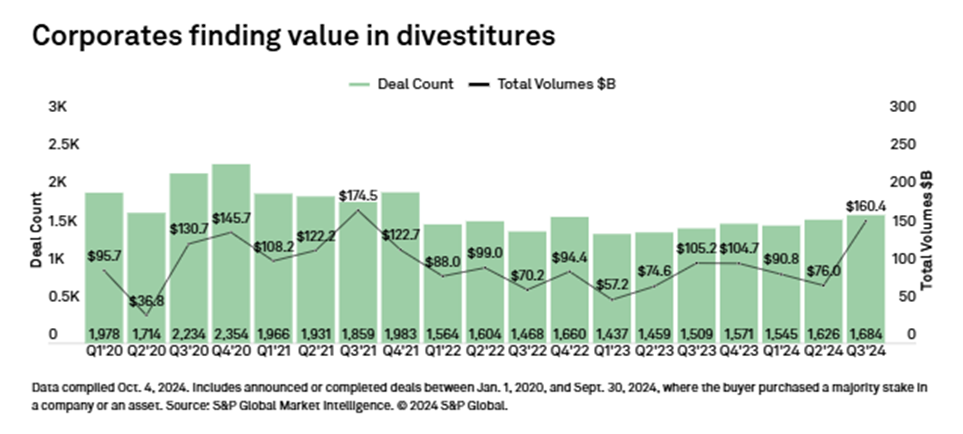

S&P Global reports positive signs of a growing M&A market. Global deal numbers have increased for the second quarter in a row, and the Q3 2024 deal number was higher than last year. In addition, total deal value has almost doubled, largely caused by eight megadeals >US$10B. https://www.spglobal.com/market-intelligence/en/news-insights/research/global-m-a-by-the-numbers-q3-2024

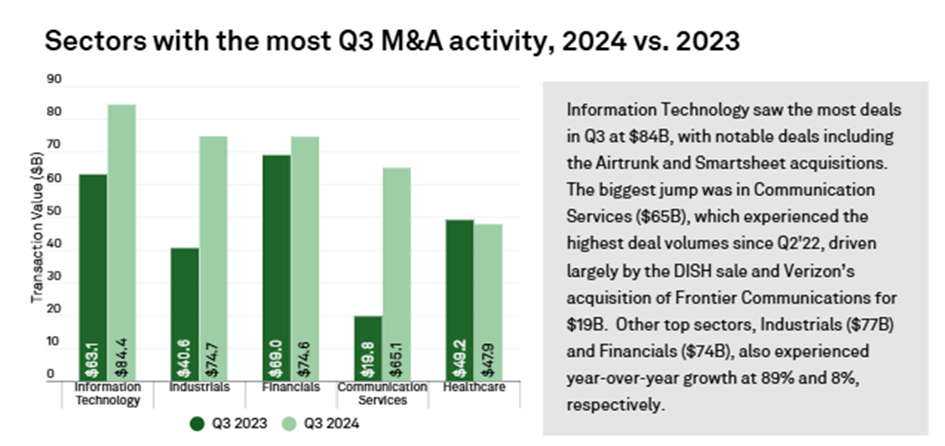

Sectorwise, the highest growth was reported from Information Technology, Communication Services and Industrials.

https://www.spglobal.com/market-intelligence/en/news-insights/research/global-m-a-by-the-numbers-q3-2024

We at MARKABLES are well prepared to support the growing need for market data to value the intangible assets of the acquired companies. In particular, we have developed our offering in the area of technology and software assets.

The acquisition of Kellanova by Mars was by far the largest deal announced in Q3 2024, according to S&P Global, with a transaction value of US$36B. Good to see that conservative consumer good investments have a promising future in a tech-dominated environment.

Kellanova is a leading global company active in snacking, cereal and noodles, plant-based foods and frozen breakfast, with famous brands such as Pringles®, Cheez-It®, Pop-Tarts®, Rice Krispies Treats®, NutriGrain® RXBAR®, Kellogg’s® (international), Eggo® and MorningStar Farms®. This deal will certainly line up among the Top10 of the most expensive brand portfolios ever acquired.

Analysts anticipate that President-elect Donald Trump’s administration will revitalize the recent slowdown in the M&A market. After a few years of lower deal activity and blocked transactions, observers expect Trump’s second term will usher in a surge of new deals. Trump’s campaign promoted a pro-business agenda with promises of extensive deregulation.

Goldman Sachs chief U.S. equity strategist David Kostin noted in an analyst report published Wednesday that the Federal Trade Commission and the Department of Justice Antitrust Division, which have previously taken a stringent approach to many proposed mergers, will likely adopt a more lenient stance under the new administration.

Goldman Sachs forecasts a 20% rise in M&A activity in 2025. In recent years, M&A activity had experienced a notable decline, with Goldman estimating a 15% drop in 2024 compared to the previous year.

MARKABLES’ selection of market comps for the valuation of IP is second to none in the sector.

Are your deal teams prepared for a growing market? And are your valuation teams prepared for growing valuation needs? MARKABLES is well prepared to support you with our wide and up-to-date offering of market data for intangible asset valuations.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland